They are issued free of cost in a specific proportion decided by the company. For example the company may decide to give out one bonus share for every ten shares held.

Ordinary Shares Definition What Causes Change In Shares Oustanding

What Is Bonus Shares When The Additional Shares Are Allotted To The Existing Shareholders Without Receiving Any Additional Payment From Them It Is Known Ppt Video Online Download

Malaysia Young Investor Bonus Issue What Is It Good Or Bad

What Is A Bonus Issue.

Bonus issue meaning. A bonus issue is when existing shareholders get extra shares in a certain proportion. Bonus Shares is a conversion of the companys accumulated earnings which are not given out in the form of dividends but converted into free shares. Regular plural bonus issues.

These are free shares that the shareholders receive against shares that they currently hold. But this can be beneficial as the market reach of the stock increases. A bonus issue to put it real simply is free shares for existing shareholders.

When a company offers 14 bonus shares it means a shareholder will get 1 free share for 4 shares held. This means that except where the bonus issue is being carried out for the purpose of paying up any amounts unpaid on existing shares a bonus issue of shares can be paid up out of either distributable or non-distributable reserves. Bonus share is issued to each shareholder according to their stake in the company.

1 for 2 bonus issue - means weve now got 3 where we used to have 2 32 2 for 5 - now got 7 used to have 5 75 3 for 4 - now got 7 used to have 4 74. 1 The issue of bonus shares enhances the companys value and increases positions and image in the market gaining the trust of existing shareholders and attracting several small investors to be a part of the stock market. An occasion when a company changes its profits into shares and gives these shares to shareholders.

A bonus issue can be in. A bonus issue of shares is excluded from the definition of distribution in section 829 of the Companies Act 2006. It is also sometimes called a scrip issue or capitalisation issue because part of the companys undistributed reserves or profits are capitalised and used to pay up the issue of the shares.

Increase in the number of shares reduces the price per share. These are free shares that the shareholders receive against shares that they currently hold. A bonus issue is a signal that the company is trying to expand equity and increase liquidity but it can not be considered as a performance indicator.

1st Jan 100 shares in issue 1st July 1 for 2 bonus issue ie. When price per share of a company is high it becomes difficult for new investors to buy shares of that particular company. 2 The companies have more free-floating shares with the issue of.

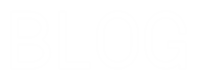

Bonus Issue defined as free new shares issued to the existing shareholders based on the specified proportion of shares they are holdings which will be at free of cost. Bonus issue increases the Paid-up share capital and reduces the reserve and surplus retained earnings of the company. Companies issue bonus shares to encourage retail participation and increase their equity base.

Bonus issue definition an issue of free shares distributed pro rata to existing stockholders instead of a dividend. Bonus shares are mainly used as an alternative to paying cash dividends. A bonus issue is a stock dividend allotted by the company to reward the shareholders.

A company may decide to distribute further shares as an. These allotments typically come in a. Investment Stocks A bonus issue is the distribution of free shares of stock among existing shareholders based on the number of shares they own.

Bonus issues result in a price reduction of the stock. Bonus share issues are essentially the capitalization. The bonus shares are issued out of the reserves of the company.

What is a Bonus Issue. In fact bonus issue leads to fall in the share price in the immediate term. For example if a 41 bonus issue is announced shareholders will receive four shares for every one share they hold.

This means that the company will issue a total of 8000 100000 x 2 25 shares to its existing shareholders. A bonus issue is an offer given to the existing shareholders of the company to subscribe for additional shares. The total equity of the company therefore remains the same although its composition is.

For example a company has 100000 issued shares in the market and announces a 2 for 25 bonus issue shares. If a stock is valued at Rs1000 after a bonus issue the price will come down making it easier for people with low capital to buy higher quantities of these shares. This is known as a bonus issue of shares.

A bonus issue is a stock dividend allotted by the company to reward the shareholders. The share price then further increases or decreases depending on the fundamentals and growth prospects of the company. These are shares issued as a gift to the existing shareholders depending on the number of shares held by them.

Instead of increasing the dividend payout the companies offer to distribute additional shares to the shareholders. A bonus issue also known as a scrip issue or a capitalization issue is an offer of free additional shares to existing shareholders. The easy way to issue new shares in your company - for only 5999.

For example it would usually be stated as 1 bonus share for every 10 existing shares. What is Bonus Issue. Bonus Fraction Calculation - Bonus issue.

A bonus issue does not really add to shareholder wealth but. A bonus issue of 31 means that for every 3 shares held by a shareholder one bonus share is allotted to the shareholder. If you have 1000 shares you are going to receive 100010 x 1 100 additional shares.

From an accounting perspective a bonus issue is a simple reclassification of reserves which causes an increase in the share capital of the company on the one hand and an equal decrease in other reserves. Bonus shares are issued from the reserves of the company. You will end up with 1100 shares after the bonus issue.

The bonus shares are issued out of the reserves of the company.

What Is Bonus Share Yadnya Investment Academy

Chapter No 9 Dividend Policy Decision Bonus Issue Rights Issue Ppt Video Online Download

35 Distinguish Between Right Issue And Bonus Issue Youtube

Rights Issue And Bonus Issue Icsi Pages 1 12 Flip Pdf Download Fliphtml5

Right Issue Vs Bonus Issue Top 6 Differences You Must Know

Corporations And Trusts Law Chapter 7 Share Capital

Provisions With Respect To The Issue Of Bonus Shares Under The Companies Act 2013 Ipleaders

Rights Issue Of Shares