Treasury Yield Curve Methodology. Treasury yield spread is the difference between the Feds short-term borrowing rate and the rate on longer-term US.

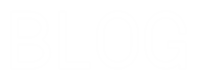

Treasuries Breaching 1 On Democratic Win May Just Be The Start Bloomberg

Bond Market Smells A Rat 10 Year Treasury Yield Hit 1 04 Highest Since March 30 Year 1 81 Highest Since February Mortgage Rates Jumped Wolf Street

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

The 10-2 Treasury Yield Spread is the difference between the 10 year treasury rate and the 2 year treasury rate.

Us treasury yield. This curve which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. A 10-2 treasury spread that approaches 0 signifies a flattening yield curve. 3 2006 the yield on the one-year note was 438 a bit higher than the yield of 437 on the 10-year note.

Investors analyze the shape of the yield curve and the changes to its shape to gain a sense of. The Treasury yield is the interest rate that the US. On a daily basis Treasury publishes Treasury Yield Curve Rates Treasury Real Yield Curve Rates Treasury Bill Rates Treasury Long-Term Rates and Extrapolation Factors and Treasury Real Long-Term Rate Averages.

The precious metal has risen 235 percent yesterday on the COMEX. This means that investors can. The yield on the benchmark 10-year Treasury note fell 39 basis points to 1636 at 440 pm.

In January 2006 the yield curve started to flatten. This was the dreaded inverted yield. 1 Year change 9352.

This curve which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. That means the 10-year yield is. Get updated data about US Treasuries.

The US 2-year T-bond yield has gained one basis point up to 0504 while the 20s and 30s followed the 10-years footsteps falling two and a half and one basis point respectively to end up at 2. Find the latest information on Treasury Yield 30 Years TYX including data charts related news and more from Yahoo Finance. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period.

US 10 Year Note Bond Yield was 163 percent on Tuesday November 23 according to over-the-counter interbank yield quotes for this government bond maturity. Daily Treasury Yield Curve Rates are commonly referred to as Constant Maturity Treasury rates or CMTs. Oil traded mixed with Brent crude falling for.

The charts above display the spreads between long-term and short-term US Government Bond Yields. Name yield relative change absolute change Trade Time US. Each of the Treasury securities T-bonds T-bills and T-notes has a different.

Treasury Yields Predicted the 2008 Financial Crisis. Treasury Interest Rate Statistics. Department of the Treasury Historically the United States Government Bond 10Y reached an.

Data delayed at least 20 minutes as of Nov 24 2021 0044 GMT. Yields are interpolated by the Treasury from the daily yield curve. The 20-Year was discontinued at the November 2009 Quarterly Refunding in favor of a 30-Year TIP security.

US 10 year Treasury. A negative spread indicates an inverted yield curveIn such a scenario short-term interest rates are higher than long-term rates which is often considered to be a predictor of an economic recession. On July 27 2004 Treasury sold a new long-term TIP security and expanded this table to include a 20-year Real CMT rate.

Like the Federal Reserve in the US or the Bank of England in the UK. View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. US stocks turn mixed closing near session highs as the 10-year Treasury yield gave up most gains.

It meant that investors did not require a higher yield for longer-term notes. In October 2021 the yield on a 10 year US. Find information on government bonds yields muni bonds and interest rates in the USA.

Yields are interpolated by the Treasury from the daily yield curve. The flags mark the beginning of a recession according to Wikipedia. The Treasury yield real curve is estimated daily using a cubic spline model.

Micro Treasury Yield futures were launched in mid-August as a complement to existing CBOT deliverable US Treasury Note and Bond futures as a cash-settled alternative priced directly in yield 2The focal point was the 10-year contract 10Y long established as a leading interest rate indicator and liquidity source. Get our 10 year Treasury Bond Note overview with live and historical data. Treasury Yield Curve Rates.

Silver prices fell below Rs 65500 per kg on October 21 as the US Treasury yield rebounded and the US dollar firmed up. The width of the yield spread helps to predict the state of the economy over the course of the next year. The yield on a 10 yr treasury bill represents the return an investor will receive by holding the bond for 10 years.

Treasury note was 158 percent forecasted to drop to 12 percent by May 2022. Government pays to borrow money for different lengths of time. Todays Change-0003 -020.

The yield of the US 10-year treasury fell from above 157 to session lows around 154 though has subsequently recovered back to just under the 156 mark. These rates are commonly referred to as Constant Maturity Treasury rates or CMTs. The yield on the 30-year Treasury bond fell 59 basis points to.

Treasury and basic bond investing tips from CNNMoney including current yield quotes breaking news commentary and more on US.

1

Chart Of The Day The 10 Year Treasury Yield Goes Its Own Way The Real Economy Blog

United States Treasury Security Wikipedia

James Picerno Blog Us Treasury Yield Curve Steepens To 3 Year High Talkmarkets

Dividend Yields Vs Bond Yields An Easy Pick Markets Insider

How The Treasury Yield Curve Reflects Worry Chicago Booth Review

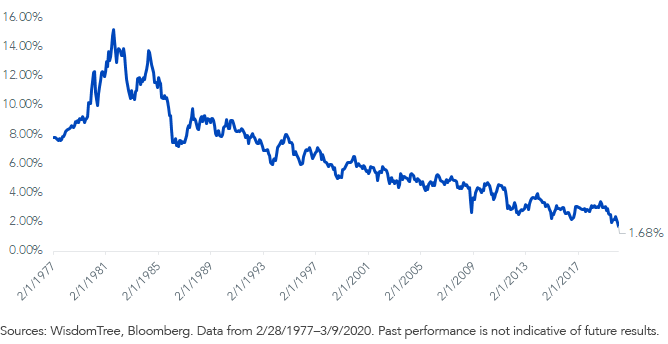

Why The 10 Year Treasury Yield Is At Record Lows

Not In My Lifetime How The Treasury Yield Collapse Surprised Nearly Everyone Reuters